https://onenewsnow.com/perspectives/bryan-fischer/2014/04/15/16th-amendment-irs-has-no-legal-authority-to-tax-your-wages-or-salary

https://www.efile.com/frivolous-arguments-against-taxes-and-why-taxation-is-wrong-illegal-unconstitutional-unfair/

Bill Of Rights Added To Constitution Guaranteeing Individual Rightsii

The First Amendment versus the IRS and the Johnson amendment

https://www.congress.gov/bill/114th-congress/house-bill/25

Update HR 25

https://www.congress.gov/bill/114th-congress/house-bill/25

There is one summary for H.R.25. Bill summaries are authored by CRS.

Shown Here: Introduced in House (01/06/2015)

FairTax Act of 2015

This bill is a tax reform proposal that imposes a national sales tax on the use or consumption in the United States of taxable property or services in lieu of the current income and corporate income tax, employment and self-employment taxes, and estate and gift taxes. The rate of the sales tax will be 23% in 2017, with adjustments to the rate in subsequent years. There are exemptions from the tax for used and intangible property, for property or services purchased for business, export, or investment purposes, and for state government functions.

Under the bill, family members who are lawful U.S. residents receive a monthly sales tax rebate (Family Consumption Allowance) based upon criteria related to family size and poverty guidelines.

The states have the responsibility for administering, collecting, and remitting the sales tax to the Treasury.

Tax revenues are to be allocated among: (1) the general revenue, (2) the old-age and survivors insurance trust fund, (3) the disability insurance trust fund, (4) the hospital insurance trust fund, and (5) the federal supplementary medical insurance trust fund.

No funding is allowed for the operations of the Internal Revenue Service after FY2019.

Finally, the bill terminates the national sales tax if the Sixteenth Amendment to the Constitution (authorizing an income tax) is not repealed within seven years after the enactment of this Act.

Congress-Gov

https://www.congress.gov/help/legislative-glossary/#glossary_billsummary

The question is why does the press only talk about democrats and Republicans?

Are our politicians serving our country and risking their his/her life to protect our freedom?

Do they have an education on how to teach the children of tomorrow?

Do they represent the views of 92% of Americans that believe in God?

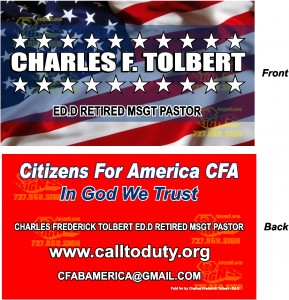

Charles Frederick Tolbert EdD, pastor, retired MSGT and Vietnam veteran Was a candidate for US Senate Florida Citizens for A Better America (CFABA) Www.calltoduty.org

501(c)(3) for a violation of the First Amendment

The 501c3 application is an example of the churches crossing boundaries seeking and consenting to the jurisdiction of and regulation by the federal government. And, of course, what the government silences under 501c3 is political speech. Such jurisdiction and regulation is contrary to God’s revealed word and God’s law.

For example, because homosexual marriages has become politicized… criticizing it…or criticizing politicians in favor of it…from the pulpit could be considered at one extreme as church involvement in politics (an IRS 501c3 no-no) or at the other extreme as ‘hate speech’.

Jesus did indeed say, “Render to Caesar the things that are Caesar’s;” but that’s only half the verse! Jesus went on to say, “and to God the things that are God’s.” The obvious question to be asked is at what time did Jesus place His church under the authority and jurisdiction of Caesar (the State)?

Mark 12:17 is the most brilliant teaching on lawful authority and legal jurisdiction that anyone has ever uttered. We can properly interpret Jesus’ teaching in this way, “Don’t render to Caesar the things that don’t belong Caesar.”

Only the “sovereign” (the supreme power) has the authority to impose a tax, and he may do so only upon his own citizen and subjects. Is the State sovereign over Jesus Christ and His body, the church?

No, the civil government has no such lawful authority, biblically or constitutionally. If the civil government has the authority to tax the church, the church is a subordinate and a subject of the State.

God ordained both the church and the civil government, and has delineated their respective spheres of authority. There should be mutual accountability between the church and the State, but one is not an underling of the other.

America’s Founding Fathers forever abolished the old State-Church and Church-State systems. However, those who would now advocate that the church should be subordinate to the State are, in reality, calling for a return of that old State-Church system.

For the church to apply to the government to be exempt from taxes presupposes that the government has legitimate authority to impose taxes on the church to begin with. Such thinking smacks of Erastianism.

The doctrine, advocated by Thomas Erastus, of the supremacy of the state over the-church in ecclesiastical matters.

Amendment XVI

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.

The IRS was not Established in the constitution.

The IRS was established by Congress who had the right to collect taxes.

The IRS does not need to be close by amending amendment 16.

Congress needs to approve HR 25 and close the IRS.

To promote freedom, fairness, and economic opportunity by repealing the income tax and other taxes, abolishing the Internal Revenue Service, and enacting a national sales tax to be administered primarily by the States.

Sponsor: Rep. Rob Woodall [R-GA7]

Status:

This bill is in the first step in the legislative process. Explanation: Introduced bills and resolutions first go to committees that deliberate, investigate, and revise them before they go to general debate. The majority of bills and resolutions never make it out of committee (H.R. 25: Fair Tax Act of 2011)

Boortz N., Linder J., and Woodall R. (2008). Wrote several books(the first in 2005) outline and explaining the Bill H.R.25, but yet six years later we are still struggling with a tax system which creates equality for every individual regardless of race, creed, color, religion or sexual preference. In 2011 the 112th Congress: 2011-2012 received an assignment “To promote freedom, fairness, and economic opportunity by repealing the income tax and other taxes, abolishing the Internal Revenue Service, and enacting a national sales tax to be administered primarily by the states.

Accordingly

The battle cry “No taxation without representation!” was a great political slogan coined to counter the Sugar Act of 1764. In order to help recoup the debt it incurred during the French and Indian War (or the Seven Years’ War), the British Parliament passed the act, which taxed all manner of foodstuffs imported into the colonies. The Americans, in the midst of economic depression following the war, were not particularly enamored of a new tax. Some have written that the Americans were simply whining tax evaders. The slogan was good for rallying the troops with an easy issue for

everyone to discern: that since they were not represented in Parliament, the tax should not be levied. However, the ultimate goal of most of the agitators was not representation in Parliament, but independence.

Even though most American believe, as I did we should have representation we do not, however when H.R. 25 is passed we will be represented by what we purchase. Which in fact means every individual regardless of their immigration status or race, creed, color, religion or sexual preference, will also be represented. Non-profit organization as well as the rich and poor will pay federal taxes one time, at the time of purchase, thus allowing manufacturers to return to producing items made in America.

Boortz N., Linder J., and Woodall R. (2008p. p.xxv) writes that the elimination of the IRS would mean we would not have, federal income taxes, payroll taxes, self-employment taxes, capital gains taxes, gift or estate taxes, alternative minimum taxes, corporate taxes, payroll withholding taxes, no taxes on Social Security benefits or pension benefits, no personal tax forms, no personal or business income tax record keeping and personnel income tax filing whatsoever.

Just think about it anyone on vacation, illegal immigrates, people paying and receiving cash, non-profit organization will all be paying federal tax to reduce the U.S.A Dept, support education, health care and social security. Money will be re-invested in to our businesses and manufactures will want to open new factories.

The Fair Tax Act (H.R. 25/S. 13) would apply a tax once at the point of purchase on all new goods and services for personal consumption. The proposal also calls for a monthly payment to all family households of lawful U.S. residents as an advance rebate, or “prebate”, of tax on purchases up to the poverty level.[2 (FairTax) The sales tax rate, as defined in the legislation for the first year, is 23% of the total payment including the tax ($23 of every $100 spent in total—calculated similar to income taxes). This would be equivalent to a 30% traditional U.S.A. sales tax ($23 on top of every $77 spent—$100 total, or $30 on top of every $100 spent—$130 total).[5] After the first year of implementation, this rate is automatically adjusted annually using a predefined formula reflecting actual federal receipts in the previous fiscal year.

The effective tax rate for any household would be variable due to the fixed monthly tax rebates that are used to “untax” purchases up to the poverty level.[3] The tax would be levied on all U.S. retail sales for personal consumption on new goods and services. Critics argue that the sales tax ratedefined in the legislation would not be revenue neutral (that is, it would collect less for the government than the current tax system), and thus would increase the budget deficit, unless government spending were

equally reduced.[5]

The sales tax rate, as defined in the legislation for the first year, is 23% of the total payment including the tax ($23 of every $100 spent in total—calculated similar to income taxes). This would be equivalent to a 30% traditional U.S. sales tax ($23 on top of every $77 spent—$100 total, or $30 on top of every $100 spent—$130 total).[5] After the first year of implementation, this rate is automatically adjusted annually using a predefined formula reflecting actual federal receipts in the previous fiscal year.

Boortz N., Linder J., and Woodall R. (2008). Fair Tax: The Truth. Harper NY NY

H.R. 25: Fair Tax Act of 2011,found on Sept 26, 2011on

http://www.govtrack.us/congress/bill.xpd?bill=h112-25

FairTax found on September 27, 2011 on http://en.wikipedia.org/wiki/FairTax

Charles Frederick Tolbert EdD retired MSGT

Was a Write in Candidate for U.S. senate Florida 2016 Citizen For America Party of Florida

https://www.academia.org/the-irs-the-constitution/

https://onenewsnow.com/perspectives/bryan-fischer/2014/04/15/16th-amendment-irs-has-no-legal-authority-to-tax-your-wages-or-salary

https://www.efile.com/frivolous-arguments-against-taxes-and-why-taxation-is-wrong-illegal-unconstitutional-unfair/

https://www.irs.gov/irm/part9/irm_09-001-002.html

https://www.irs.gov/pub/irs-pdf/p2105.pdf

My argument is the passing of the bill of HR 25 which is fair taxable where you have a consumption tax at time of purchase

In addition to the fact that the federal government has taken money out of the Social Security and used it for frivolous purposes this money must be returned to the people

Isaiah 42: 1 1 “Here is my servant, whom I uphold, my chosen one in whom I delight, I will put my Spirit upon him, and he will bring justice to the nations.

Dr. Tolbert does not accept donations, and yet Scott and Nelson will spend more than $ 50 million in taxpayer money while applying for a political office.

https://ballotpedia.org/United_States_Senate_election_in_Florida,_2018

Charles Frederick Tolbert EdD

PO Box 2798

Okeechobee FL 34973

Www.writeintolbert.com

Bachelor’s degree Organizational Effectiveness (BS)

Master of Theology (DIVM)

Master of Education and Technology (EdM)

Doctor in Educational Leadership (EdD)

Request your support for Dr. Tolbert to be the next Veterans Administration Secretary

https://www.cfabamerica.com/resume-of-dr-charles-tolbert-sent-to-donald. 1.

Seven articles under review and editing for the veterans administration talk radio April 24, 2018

Charles F Tolbert BS, DIVM, EdM, EdD

Retired MSGT

Shepherd

Candidate for the Senate of the United States, Fl 2018

Www.calltoduty.org

Cfabamerica@gmail.com

Www.cfabamerica.com