Wanted

One Good Person for President of the United States of America

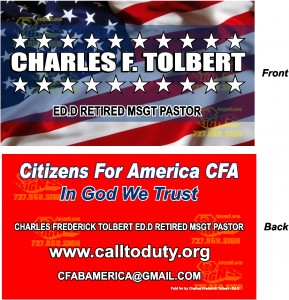

Charles F. Tolbert EdD

Citizens for a Better America (CFABA, inc.)

In 1962 the late President John F Kennedy wrote, “If some chance keeps you from the presidency, you will still know that you are prepared to serve well your nation as a citizen.” J. F. Kennedy (1962), How to prepare for the Presidency. New York, N. Y. Parade Pub, Inc.

Over the past several months I have written articles concerning the voucher system, education, and a series of ” what if” articles. In this article, I will present another “What if” question. What if – a stimulus package paid all lenders of all students that currently have student loans?

In so doing, the students would have an increase of disposable income, which they could use to purchase items, and in many cases keep them from filing bankruptcy. We should note that student loans are not forgiven in bankruptcy.

Like all other Americans, we are bettering ourselves in order to provide not only a better life style for ourselves and our families, but also to keep America ahead of other countries. Yet, because of the fact that education is a privilege, and not a right, we have to borrow money in order to further our knowledge.

What if – after all student loans were repaid by this method, the government made available a $60,000 scholarship fund for all undergraduate and graduate students, and a non-interest buying loan for all doctoral students According to Ben Miller June 10, 2008 “Last school year, nearly 40 percent of all undergraduates-about 6.8 million individuals-took out a total of $39 billion in federal loans. That’s an increase of more than 50 percent in loan volume and nearly 60 percent in number of borrowers over the last decade. The first thing to realize is that there are two different types of loans: Stafford loans and Parent Loans for Undergraduate Students, more commonly referred to as PLUS loans. Stafford loans are more common and are available for all students, regardless of income, that meet minimum eligibility requirements. Low-income Stafford borrowers, however, receive a few additional benefits such as an interest rate that is will be halved over the next few years. If Stafford loans aren’t sufficient to cover all educational expenses, like housing and books, borrowers and families can also take out PLUS loans. Unlike Stafford loans, which are borrowed in the student’s name, parents or guardians take out PLUS loans at a slightly higher interest rate with larger limits. Parents can take out any amount up to the cost of attendance minus any other financial aid received. PLUS loans, however, are not an entitlement parents with bad credit can be rejected. .

For comments or suggestions, please call 561-398-9025 or e-mail Dr Tolbert at Cfabamerica@gmail.com

. In or about 2002, I started going to school for my Masters In Education, and in 2004 began my Doctoral Degree in Educational Leadership with Nova Southeastern University. I believe that this is a norm for most individuals who are working toward a doctoral degree. Although I finished my bachelors degree in business science in 1982, with the University of Maryland; this degree was covered by the G. I. Bill, since I am a retired Master Sergeant. I felt a need to further my education in order for me to be an expert in this field of study. I am a doctoral candidate at Educational Leadership at Nova Southeastern University (finished 2010) served 22 years in the Army, retired in 1981, after which I owned my own company. Currently the overseer of CFACS Inc. You can view my resume at www.cfabamerica.com and contact me at cfacs@gate.net. 561-398-9025

Vote: Charles F. Tolbert was a candidate for US Senate Fl 2016 NPA

Dr Tolbert DivM, EdM, EdD

Retired MSGT

Pastor