Dr. believes June 2018 would be the appropriate time to discuss Social Security on American Freedom Watch Radio.

Dr Tolbert

Per Karen Schoen

American Freedom Watch Radio

Thanks Charles.

How about a conversation on the radio?

I have been thinking about this for a long time.

You are right and the public needs to know.

I have a simple solution.

1. Reeducate the value of American citizenship.

2. American citizens own America.

3. The American land mass is one of the richest in the world.

4. The wealth of the public lands belong to the American citizen not politicians.

5. That wealth should be used to fund the social programs.

6. Every American citizen should pay 5-10% Fed taxes – (skin in game) and must take continuing yearly civics classes to qualify. This way they are contributing not getting something for nothing.

Dr Tolbert

1. Fair tax law HR 25

2. Return of stolen money by the federal government to Social Security

3. Illegality of withholding taxes and Irs

4. The reduction of welfare program increasing education, production and defense

5. Should Social Security be privatized or continue under the control of politicians and the federal government?

6. Showed the age of individual paying Social Security be reduced to 13 years old and increased to 70 years old?

7. Should Social Security, military retirement and other retirement checks be taxed?

On May 24, 1937 the Supreme Court ruled 7-2 that the new Social Security program, based on the government’s broad power to tax, was fully constitutional.

Formatted and updated March 18, 2018

Articles on Social Security, Medicare, and Obama care

http://www.blogtalkradio.com/americanstatesman/2015/11/24/t-g-i-f–thank-god-im-free-on-this-thanksgiving-day–2015

Articles on Social Security and individuals that want to maintain its legality do not explain the constitutional violation of our rights and excise tax placed on a retirement program that contradicts the Constitution.

Although there has to be a better substitution, the question is; do we debate the issue in an article, or for now not make it one of the issues that we would want to review as a senator.

A forced retirement program is what Social Security is and although I benefit from social security I support the constitution more which overrides anything that may work to my advantage and to deny its legitimacy or to affirm it, I think creates an issue.

It would take a constitutional amendment to secure Social Security as a right rather than the way it is currently presented.

Although there are contradictions on privatizing of security, we have to understand that the federal government starting back with many of our presidents took money out of Social Security illegally to offset areas where they did not get budget approval. This is why social security is faced with a deficit today.

In conclusion; the federal government needs to repay all of its loans borrowed from social security for other debts and replace it in Social Security, and then there has to be a decision about how to correct the constitutionality and make it so it is not an excise tax.

The reason being, Congress is the only one that can establish taxes. This is reflected in Obama care where the Supreme Court ruled that Obama care is an excise tax which is based on the same principle as security.

The constitutionality of the Social Security Act was settled in a set of Supreme Court decisions issued in May 1937.

When the new law was enacted based on the power to levy payroll taxes, it was immediately challenged in the courts. And Justice Stone’s provident prediction bore out. On May 24, 1937 the Supreme Court ruled 7-2 that the new Social Security program, based on the government’s broad power to tax, was fully constitutional.

Conceptually, the old-age insurance program was a social insurance program with an obvious connection between the taxes collected in Title VIII of the Act and the benefits paid in Title II of the Act. The taxing and spending provisions of the Act were placed in separate titles in the vain hope of convincing the courts that what was obvious was not the case–that is, so that the argument could be made that the taxing and spending provisions had nothing to do with each other. Whether such a strategy would work was highly questionable–especially following the ruling on the AAA. But as it would turn out, the Court itself would change in ways that rendered the strategy moot and the Social Security Act safe from legal challenge.

https://www.ssa.gov/history/court.html

If the Supreme Court holds that the Affordable Care Act’s individual mandate, which requires every American adult to purchase health insurance or pay a fine, is unconstitutional, why could not Social Security be next? After all, it requires nearly every American to purchase retirement coverage? What about Medicare, which requires every working adult to purchase old age medical insurance?

http://m.huffpost.com/us/entry/1443600

The constitutionality of both of these federal mandates is not being challenged, even by most in the Tea Party. Nor have we heard charges that Social Security is a takeover of private pension care or Medicare a takeover of private health care. No one is claiming that Social Security takes away your choice of pension options or that Medicare takes away your choice of doctors. To the contrary, the great majority of Americans do not want anyone messing with these federal mandates.

There’s no authority [in the Constitution]. Article I, Section 8 doesn’t say I can set up an insurance program

“The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defense and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States.”

Social Security tax or FICA (Federal Insurance Contributions Act) is another tax taken out of your paycheck as withholding, or self-assessed as self-employment tax. Where’s the authority for this and who does it apply to?

“IRC (Internal Revenue Code) 3101. Rate of tax.

(a) Old-age, survivors, and disability insurance. In addition to other taxes, there is hereby imposed on the income of every individual a tax equal to the following percentages of the wages (as defined in section 3121(a)) received by him with respect to employment (as defined in section 3121(b).”

Again, this is just another excise tax imposed on income, in addition to other taxes, and has nothing to do with any type of insurance. Since an excise tax is a tax on a privilege, then what’s the privilege here? The privilege is a wage received with respect to employment. Is employment a government granted

privilege? Yes, since the government property (U.S. citizen) is employed by a business that makes every employer a government employee. But notice that, again, the tax is a percentage of wages. Do you receive wages?

http://www.usa-the-republic.com/revenue/true_history/Chap7.html

The TRUTH is that Social Security is just a fringe benefit, for any U.S. citizen who is a subject of the federal government. And the qualifications for Social Security are easy. You just have to be a U.S. citizen/subject and pay in for 10 years. In the Supreme Court case of Flemming v. Nestor, 363 U.S. 603 (1960) the Supreme Court ruled that Congress is paying Social Security benefits under the same constitutional authority that it doles out Aid to Families with Dependent Children and to those receiving food stamps. The Court said that workers have no legal claim to either their accrued contributions or to their anticipated benefits. And Congress can stop these benefits at any time they want. Remember, privileges and immunities for citizens/subjects can be granted and withdrawn by the government at will. You have no ‘right’ to Social Security benefits, even if you paid in for 50 years, because it is NOT insurance. It is just a tax, to be doled out as willed. You are just on welfare, being paid from the income made by others! It is a giant pyramid scheme that would be illegal if you tried to implement a retirement program like this yourself. And it can be discontinued or changed at any time.

Remember, the social security tax is an excise tax on a privilege. The privilege is, being employed by the government in the jurisdiction of U.S. federal territory. Can you be forced to accept a privilege, so you can be taxed on that privilege? No. To engage in a privilege is still voluntary. But, the government is working on that. They have made it almost mandatory to accept the privilege of Social Security. After all, you can’t get “employment” in the “United States” without a Social Security card. And if you go to the doctor, they want your Social Security number. And in some states you can’t get the “privilege” of liberty (driver’s license) without a social security number. You didn’t know that liberty was now a privilege, and not an inalienable right? United States citizens have this “privilege” of liberty. American sovereigns have the inalienable right of liberty. They can drive to the grocery store without permission (driver’s license) from the government. Another whole book subject!

It would take many legal debates on Social Security’s legality but to read and understand it fully would take a large committee and many years to redesign, re-organized and implemented on a voluntary basis rather than mandating that a tax on a privilege is unconstitutional.

This presentation is to provide information on both sides of the issue of the legality of Social Security and why it enhances a socialist economy as does Obamacare.

There has to be a better solution.

Conclusion: before any political party or group of individuals challenge the legality and constitutionality of Social Security, lawsuits need to be made against the federal government to include Congress, the President and the Supreme Court for misappropriation of the American funds and taxes and the usage of those funds tended for Social Security.

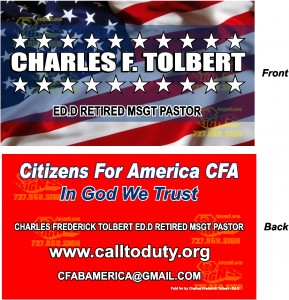

Charles Frederick Tolbert EdD

Was a Candidate for United States Senate Florida 2016 NPA

Retired MSGT

Pastor

Dr. Allen W. Smith is a Professor of Economics, Emeritus, at Eastern Illinois University. He is the author of seven books and has been researching and writing about Social Security financing for the past ten years. His latest book is Raiding the Trust Fund; Using Social Security Money to Fund Tax Cuts for the Rich. Read other articles by Allen, or visit Allen’s website.

by Allen W. Smith / November 28th, 2009

“The mishandling of Social Security funds has been going on since the mid-1980s. As soon as the surpluses, resulting from the 1983 payroll tax hike, first began to flow into the Treasury, politicians from both political parties began using the money like a giant slush fund. At that time, it would be at least 30 years before the funds would actually be needed for Social Security, so politicians developed the bad habit of “temporarily borrowing” the money and using it for non-Social Security purposes. That bad habit never was broken, and every dollar of the $2.5 trillion in surplus Social Security revenue, generated by the tax hike, has been spent, leaving no real assets in the trust fund.

Some members of Congress were outraged by the practice and tried to nip this misuse of Social Security revenue in the bud. On October 13, 1989, Senator Ernest Hollings of SC expressed his outrage during a speech on the Senate floor. Excerpts from that speech, taken from the Congressional Record, follow. “…the most reprehensible fraud in this great jambalaya of frauds is the systematic and total ransacking of the Social Security trust fund…The public fully supported enactment of hefty new Social Security taxes in 1983 to ensure the retirement program’s long-term solvency and credibility. The promise was that today’s huge surpluses would be set safely aside in a trust fund to provide for baby-boomer retirees in the next century. Well, look again. The Treasury is siphoning off every dollar of the Social Security surplus to meet current operating expenses of the government…The hard fact is that in the next century…the American people will wake up to the reality that those IOUs in the trust fund vault are a 21st century version of Confederate banknotes.”

A year later, on October 9, 1990, Senator Harry Reid of NV expressed similar outrage. Excerpts from his Senate speech, taken from the Congressional Record, include, “…Are we as a country violating a trust by spending Social Security trust fund moneys for some purpose other than for which they were intended. The obvious answer is yes…During the period of growth we have had during the past 10 years, the growth has been from two sources. One, a large credit card with no limits on it, and, two, we have been stealing money from the Social Security recipients of this country.”

Senator Daniel Patrick Moynihan of NY even introduced legislation in early 1990 to repeal the 1983 payroll tax increase. In an effort to keep politicians from spending the Social Security surplus money on other things, Moynihan wanted to eliminate the surplus revenue and return Social Security to a “pay-as-you-go” system. President George H.W. Bush was furious about Moynihan’s proposed legislation. Bush

said, “It is an effort to get me to raise taxes on the American people by the charade of cutting them, or cut benefits. And I am not going to do it to the older people of this country.”

Bush, the “read-my-lips-no-new-taxes” president, did not need to raise taxes as long as he had access to the surplus Social Security revenue. During his four years in office, $211.7 billion in Social Security surplus revenue flowed into the U.S. Treasury. Every penny of it was spent for general government expenditures, and none of it was saved and invested for the payment of future Social Security benefits, as is commonly believed. This practice has continued until this day. The plan was that when benefit costs start to exceed payroll tax revenue, in about seven years, the Social Security trustees would begin dipping into the huge reserve that was supposed to be built up in the trust fund to make up the revenue shortfall in order to continue to pay full benefits. Unfortunately, there are no assets in the trust fund that can be dipped into.

http://www.fedsmith.com/2013/01/21/was-the-misuse-of-social-security-money-pre-planned/

Our Social Security

Franklin Roosevelt, a Democrat, introduced the Social Security (FICA) Program.

He promised:

1.) That participation in the Program would be Completely voluntary, No longer Voluntary

2.) That the participants would only have to pay 1% of the first $1,400 of their annual Incomes into the Program, Now 7.65% on the first $90,000

3.) That the money the participants elected to put into the Program > would be deductible from their income for tax purposes each year, No longer tax deductible

4.) That the money from participants would be put into an independent “Trust Fund” rather than into the general operating fund, and therefore, would only be used to fund the Social Security Retirement Program, and no other Government program, and,

Under Johnson the money was moved to The General Fund and Spent.

5.) That the annuity payments to the retirees would never be taxed as income.

Under Clinton & Gore > Up to 85% of your Social Security can be Taxed Since many of us have paid into FICA for years and are now receiving a Social Security check every month — and then finding that we are getting taxed on 85% of the money we paid to the Federal government to “put away”– you may be interested in the following:

Q: Which Political Party took Social Security from the independent “Trust Fund” and put it into the “general fund” so that Congress could spend it? A: It was Lyndon Johnson and the democratically controlled House and Senate.

Q: Which Political Party eliminated the income tax deduction for Social Security (FICA) withholding?

A: The Democratic Party.

Q: Which Political Party started taxing Social Security annuities?

A: The Democratic Party, with Al Gore casting the “tie-breaking” deciding vote as President of the Senate, while he was Vice President of the US.

Q: Which Political Party decided to start giving annuity payments to immigrants?

A: That’s right! Jimmy Carter and the Democratic Party. Immigrants moved into this country, and at age 65, began to receive Social Security payments! The Democratic Party gave these payments to them, whether or not they ever paid a dime into it!

Then, after violating the original contract (FICA), the Democrats turn around and tell you that the Republicans want to take your Social Security away! And the worst part about it is uninformed citizens believe it!

Www.cfabamerica.com

Copy Editor, Vilet Dye…viletsvoice@yahoo.com

Virus-free. www.avast.com