I disagree with his comments

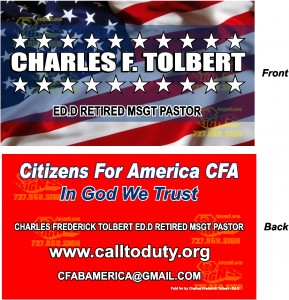

Dr Tolbert

http://keepamericaatwork.com

NumbersUSA.com

Www.calltoduty.org

http://www.blogtalkradio.com/americanstatesman/2016/10/24/america-for-sale-siemens-replaces-american-workers-with-tata-workers-from-india

Charles Tolbert EdD

Was a candidate US Senate Fl 2016

Retired MSGT

Pastor

Cfa@calltoduty.org

From CEO Jeff Immelt

General Electric

Earlier today, I delivered remarks at Georgetown University. I shared my views on globalization and why protectionism is not the answer to how we compete and win. Here are excerpts, as prepared, from my message to the students.

Many of you are studying to engage with the world on behalf of governments and companies. You hear people say we are living in unprecedented times. I am here to tell you – that is true.

Today, I want to give you some views on globalization … what works, and what doesn’t work, and what needs to change. Please keep foremost in your mind that the U.S. has 5% of the world’s population with 25% of the GDP. I hope to persuade you that – rather than pulling back – the U.S. can win the global game. But, we have to compete.

I have spent my career doing just that. When I joined GE – in 1982 – 80% of our revenue was in the U.S. In 2017, nearly 70% of our revenue will be global. We have customers in 180 countries and our exports exceed $20B. Our U.S. workers earn high wages because they make leadership products that we sell around the world. Globalization has made us become more efficient, more competitive.

We have built our global position as a proud American company. Our headquarters are in the United States, much of our technology originates here, it is our largest market and our values are American. We were all trained to believe that competing to win around the world is an imperative for an American company, and for that we would be admired.

Today, people question globalization. The U.S. is challenging trade deals and has effectively shut down its export bank. The U.S. is not alone. Protectionist barriers are rising in Europe and Asia as well. Economic nationalism is replacing free trade as the dominant idea of the era. Meanwhile, the Chinese are replacing the U.S. as the trade leader on the global stage, growing their influence through expanding relationships and economic development.

So, what happened?

How did an ideal so connected to American influence and success become so demonized? In retrospect, there were key changes along the way. I’ll name a few.

China redefined the game. China made state capitalism work. They supported their companies, while setting localization requirements to access their own market. They connected geopolitical and economic goals. They played to win and rose quickly. Over the last 25 years, China has been a force that the rest of the world reacted to. Other governments made it their mission to create jobs and capture wealth at home as part of a zero-sum game.

Globalists became too elite. Every year American and European CEOs and other global elites congregate in places like Davos. Somehow, “global thinkers” grew increasingly distant from the needs at ground level. We made globalization its own political party. The “party” saw globalization as a theory, rather than understanding the impact on normal people, or the critical investments needed to build competitiveness. We rationalized outsourcing as merely good business; long ago, GE was a part of this as well. Globalization became distrusted and disliked.

Trade deals were poorly defined. Citizens heard of TPP, NAFTA and TTIP and connected their own fear of a rapidly changing world with these agreements. Rather than seeing large trade agreements as promoting commerce that helped workers, people viewed them as gifts to big companies. And, frankly, many big companies were too comfortable hiding behind them and too slow to change models.

Meanwhile, our government failed to convince people of the important role that trade plays in building U.S. strength around the world. TPP, after all, was even more important geopolitically than it was economically. As this was happening, our competitors were on the move … building economic ties that added to their global clout.

Companies ran the easiest play. Globalization became synonymous with outsourcing and low wages. Imports grew far faster than exports. Investment declined in capital and research. Industry consolidation through M&A replaced innovation and pursuit of new global markets. The U.S. lost manufacturing jobs and gained retail jobs, while wages stagnated.

The reality is that for too long, too many global multinationals didn’t invest at home or abroad.

It is significantly harder to sell a turbine in Lagos than it is in Chicago. It is significantly easier to be an importer of cheap wages than an exporter of valuable products. Trust me, I have done both. Export-led growth is out there to be had, but it takes hard work and investment.

When companies believe that globalization is only about outsourcing … and when our country is less competitive … and when our government does not engage … and when companies reduce investing … workers suffer. That is what happened in the U.S.

Because of these factors, we are not going back to a pure free trade world. But, is protectionism the answer? I guarantee you … we have the most to lose through protectionism. If leaders think people want to live without the many benefits economic integration has enabled, they’re in for a rude awakening. We need to fight for new technologies not old ones.

I don’t consider myself to be a global philosopher. Rather, I view my role as preparing GE to compete for world markets; to do so with confidence. Our role – as a company – is to grow profitably for investors, support our employees and customers and represent our country well. We believe that the will to compete is the purest American value.

Instead of moving backward, let’s compete for the world. Let’s try harder. This is true for both the private and public sectors. For companies, we should aspire to have the same market share globally that we do in the U.S.; globalization should be more about growth than cheap wages. By so doing, we will grow exports. For government, we should level the playing field. We should make our country more competitive by embracing tax reform and infrastructure investment. At the same time, we should engage globally to make sure all markets are open for U.S. products.

GE has $80B of revenue outside the U.S.; and grew that by 19% in the first quarter of 2017. Our strategy is based on connected localization. Our advancement requires building capability on the ground in fast-growing global markets. We earn our right to compete by investing, operating, and building relationships in the countries where we do business. We will always be a strong American manufacturer. But, we also have built factories around the world, using a manufacturing strategy to open markets.

Being global and local gives us the ability to compete and win in 180 countries around the world. We are a real and regular presence in diverse markets while also maintaining a strong manufacturing and innovation footprint in the U.S. Over the last 15 years, 80% of our engines and turbines have been sold outside the U.S. When we win globally, we benefit the U.S. as well.

How Can American Companies Win?

First, U.S. companies must get more local; realize that sustainable growth requires local capability inside a global context … connected localization. Put every country in play. GE has 25 countries with more than one billion dollars in revenue. Our leadership team is filled with local talent; many of whom have built a career in GE. They are connected to the market. I don’t have to read the FT to figure out what is going on in the country. Our information is fresh and our relationships are strong.

That helps us win, even in China. We have 20,000 employees supported by multiple factories and research centers. We lead in Power, Healthcare, Aviation and Oil & Gas. We are a net exporter from the U.S. We partner with Chinese construction companies and leverage this funding to win in Africa and Asia. These activities have created jobs in both China and the U.S.

Or take India – a country where GE has been active for a century. We worked on a project for 20 years that involved global teams and sharing knowledge across the company. But what brought this project home were our connections with people on the ground. In 2015, we won a $2.5 billion order to upgrade India’s rail system. That’s because we’re a global business that’s intensely local.

American companies should reinvest in manufacturing. This is a source of competitive advantage and middle class jobs. By leading in additive manufacturing, we can make things anywhere in the world at low cost. In the past, productivity could be achieved only through low-cost labor in large factories. In the future, manufacturing will be driven by new materials, additive techniques and digitized plants. Factories will be smaller, more flexible and more globally mobile. Our goal is to make what we want, where we want, with workers who are more productive and more valuable.

Another driver of speed and productivity for American companies is digitization. The combination of physical and analytical innovation is creating substantial value. In Pakistan, we are using analytics to improve energy efficiency and expand capacity. In India, we can use the internet to deliver healthcare to remote regions. In Ethiopia, engine analytics are improving airline productivity. Digitization makes us closer to our customers, delivering value around the world. And, digitization empowers ordinary people and that strengthens globalization. It allows small businesses to connect with a broader global ecosystem.

With a local presence, American companies can solve local problems. In the past, every solution was viewed as a “global solution,” where one size fits all. In the future, companies will impact the way the world works by innovating to solve problems locally. Take global warming. Reducing pollution remains a huge need and business opportunity. American companies will penetrate huge global markets if we innovate in clean energy solutions. GE sells $5B of wind turbines outside the U.S. annually. Similarly, in emerging markets, we have unique healthcare products and a business model that focuses on cost, quality and access. We have built a $2B Healthcare business in China.

Financial solutions help to create local demand. Capital is like oxygen in global development. Here, China and Germany have been quite aggressive. “One Belt, One Road” is a brilliant strategy to utilize Chinese capital to support its exports. Similarly, Germany’s Hermes is one of the world’s most aggressive export banks. We have found ways to compete by leveraging capital from multiple pools: global ECA, Infrastructure Funds, and our own balance sheet. American companies need to be financially savvy to win around the world.

Training people is an American competitive advantage. Here, business can develop human capability better than governments. Two years ago we opened a business process outsourcing center in Saudi Arabia that will employ 3,000 women and is led by a woman. Our vision was to tap into a pool of talented Saudi women to execute process support for our activities in 50 countries. Through world-class training, they can compete with the world.

We have had decades to build a global position with all the benefits of trade institutions. Today, we need to own on our own. It is up to us to address our challenges in local markets. We do not expect the US government to do our work for us. Multinational companies today must have their own foreign policies. You win in global markets by going to them frequently, hiring local teams and developing products the local customers want, over and over; year by year, decade by decade.

The Role of Government is to Level the Playing Field

In this regard, President Trump is right. We don’t have the same opportunity to sell our products globally that is enjoyed by those selling in the U.S. or our global competitors. Trade can be made more fair, and American workers would benefit.

But let’s look in the mirror. Our national competitiveness has slipped. We should start by fixing our infrastructure; currently, we are not in the top 20 in any area. We should have better transport, broad-band, airports … the infrastructure necessary to compete. We must simplify and reduce our regulations. From the EPA to labor to healthcare … regulation has exploded in the last 20 years. Most government agencies haven’t any context for global competitiveness, nor do they seem to care. We have to learn to compete again.

The biggest driver of global competitiveness is tax reform. Most of our global competitors have modified their tax systems in the past decade. Like them, we seek a territorial system with lower rates. Much of this exists in the proposal made by President Trump last week and in the House blueprint.

At the same time, we should have a robust debate about Border Adjustment. I know this is controversial, especially when people want to protect the status quo. But our current policy: favors foreign companies operating in the U.S. over American companies operating abroad; and favors American companies who import goods manufactured outside the U.S. over companies that manufacture in the U.S. and export. In a country that wants to grow manufacturing jobs and exports, our tax system does the opposite. All of our global competitors have some form of a Border Adjustment. The entire German system is in place to help exporters. Isn’t it worth a debate?

The U.S. should revitalize and strengthen our US export finance institutions, to equip them to support American exporters and deter foreign government actions that violate the rules. Foreign governments view our bright line delineation between foreign policy and international economic policy as naïve.

Frankly, our inability to get the Ex-Im Bank up and running is pathetic. This move has our global competitors “licking their chops” by our unwillingness to compete. Every global competitor has an export bank … this is favored by two-thirds of Congress … can’t we just get on with it?

We need to simplify and make our global development institutions more competitive, and measure outcomes, not effort. Over the past decade, China invested $100B to grow in Africa. In 2013, the U.S. announced the Power Africa initiative to great fanfare, committing $7B. Since then, we have disbursed about $100M of that amount. Let’s see … $100B for China versus $100M for the U.S. That is not winning.

Lastly, the U.S. must continue to shape the terms of trade. President Trump has indicated his desire to engage bilaterally rather than through big multilateral trade deals. That is consistent with this new era. The world is moving from being one dominated by multilateral agreements and institutions to one focused on direct engagement.

The U.S. needs to continue to lead with trade agreements to help small and medium size enterprises and as a foreign policy tool for the President and the country. In other words, don’t do trade deals for GE … we can globalize on our own.

Rather than withdrawing from trade deals, we should work to modernize and improve them. NAFTA presents an opportunity for the U.S. government to do just that. We have an opportunity to create an integrated North American energy bloc which could drive down costs and incentivize U.S. manufacturing. And, with the right reforms, Mexico should be a huge market for American products.

We will not grow, if we don’t trade with people. We need to be confident and strategic. There are two levers you have when you’re President of the United States to shape international affairs. One is military, one is economic. It would be foolish to give up on an important part of our arsenal. I think President Trump is already showing signs that he will integrate our economic and geopolitical strength to get a fair deal for the U.S.

One thing I know about globalization is that there will always be plenty of critics. You have no idea how many times I have been criticized in Washington for doing business around the world. Global leaders need thick skin. It requires a long-term view to see the “win win.” Hell, to understand globalization, you actually must have a passport.

I don’t listen to people who have no global context, never been in a factory or don’t want to compete. I run a meritocracy with the highest standards. Everyone who joins GE knows they have a future if they perform. Discrimination has no place in business – in the United States or anywhere else in the world. Similarly, our factory teams know that, while we cannot guarantee markets, we can guarantee effort; we always play to win. I believe these to be American values.

I am not here to advocate for the status quo. The principles for trade need to be rethought for the modern age. The systems of free trade haven’t worked for enough people. But protectionism is not the answer. It makes us look weak, not strong. One of the core American values is the desire to compete. In sports, they say “the best defense is a good offense;” the same is true in trade.

So let’s try harder. American companies should be winning in global markets, not using them for cheap wages that harms American workers. And our government should level the playing field. Both of us should make a bold statement that the U.S. plans to build economic strength and engagement around the world. I say with 100% certainty: if American companies get a level playing field outside the U.S. and commit to global markets, America will win more business, create more jobs and reduce the trade deficit.

It is time to stop complaining and start competing.

Www.cfabamerica.com